ALIBABA IS THE OPPOSITE OF FRICTIONLESS

- share

- copy link

ALIBABA IS THE OPPOSITE OF FRICTIONLESS – AND IT WORKED FOR ITS 2019 SINGLES’ DAY

SUMMARY

Singles' Day 2019, akin to Cyber Monday or Black Friday in the US, has raked in more cash in the bank than 2018 and hit US$38.4 billion in gross merchandise volume worldwide, though the GMV number doesn't tell the complete story.

- Alibaba is the platform most associated with the mega shopping event that is not just a single-day sale but a 20-day festival. Competitors JD, Suning, and Pinduoduo all offer their own Double Eleven versions.

- A well-orchestrated series of marketing activities was designed to prime shoppers and to pump up pre-sales before the midnight kickoff. 11/11 was successful because it went beyond passive shopping but injected interactive entertainment via live-streaming and sporting elements via games to unlock discounts.

- Due to eroding margins from rising search ad costs, brand owners and retail merchants have been compelled to use Alibaba platforms less for traffic and more for new product launches, user engagement and innovation incubations.

ICYMI, Alibaba generated a staggering US$38.4 billion in online gross merchandise value (GMV) on this year’s 11.11, up 26% year-on-year, partly fueled by the countdown gala hosted by Alibaba’s video arm Youku featuring performances from Taylor Swift (pictured below), Kana Hanazawa, and Aida Garifullina.

The calculation of GMV is hazy as it includes shipping charges paid by buyers to sellers, and doubts abound about the actual total after factoring in returns or cancellations. This is Alibaba’s explanation, extracted from its last annual report: “As a prudential matter aimed at eliminating any influence on our GMV of potentially fraudulent transactions, we exclude from our calculation of GMV transactions in certain product categories over certain amounts and transactions by buyers in certain product categories over a certain amount per day”.

The GMV debate aside, Alibaba drove success by focusing on these key factors of effectiveness:

Keeping consumers longer on its sites and ensuring stickiness

Instead of trying to create frictionless experiences which are all about utility to get shoppers in and out of an e-commerce platform, Alibaba’s Singles Day has entertainment and relationship-building elements that were way beyond shopping. As Geometry’s global CEO Beth Ann Kaminkow put it, “the minute I understood that insight and I saw that difference, it explained everything for me when I start to think about how the consumer experience is changing in China. On Amazon, eBay, Walmart or other online platforms in the West, it’s really about helping the user find what they’re looking for, get it into their baskets and make the purchase happen”.

On the other hand, Alibaba’s platform strategy was not to get shoppers in and out as quickly as possible, said Kaminkow in a WARC interview, but to give them a place where they could dive deeper into the brand experience through celebrity endorsement, video content, gamification of Alibaba-owned apps, or sharing their savvy discount strategies with people around them to enhance their social currency.

Pre-sales campaigns and promotions since 21 Oct also kept consumers longer on Alibaba. Exclusive pre-sales offers encouraged consumers to add products to shopping carts 20 days prior to the event. Additional discounts only applied if shoppers paid non-refundable deposits upfront, and cancelling preorders or failing to pay balances on 11 Nov itself would cause shoppers to forfeit their deposits. These policies ensured that brand owners can generate maximum one-day GMV, pointed out Forrester’s senior analyst Xiaofeng Wang.

Under the Tmall 2.0 scheme previously only available to big brands, smaller merchants now get to upgrade their storefronts with tools for customization to deepen engagement.

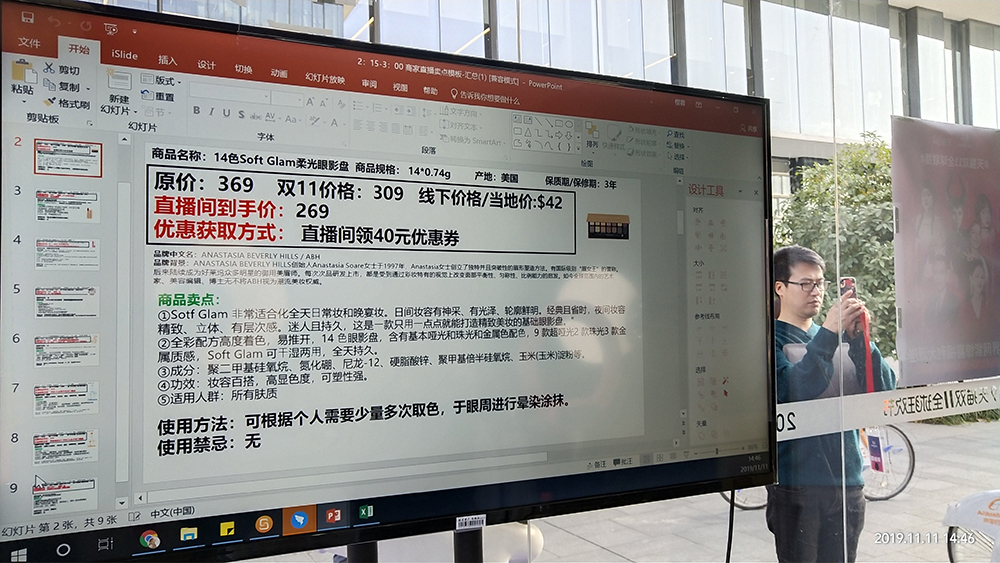

Leveraging live-streaming to drive engagement and sales

Live-streaming commerce is gaining momentum because it combines four popular elements: user-generated and promoter-generated content (UGC/PGC), vertical mobile videos, key opinion leaders (KOLs), and exclusive/limited-time offerings. While most live-streaming platforms in the West are focused on gaming and entertainment, live-streaming in China can capture consumer attention, help them discover new products, increase authenticity with real-time comments. For brand owners, the benefits lie in shortening the path to purchase and lowering the cost of user acquisition. According to Carlos Zhao, China market manager of New Zealand pharmaceuticals brand Douglas, using live-streaming to drive traffic to its online storefront on Alibaba is “much more cost-effective”, compared to buying search keywords in the past. “Almost 90% are new users too, who come and listen to the KOLs especially if they are credible,” said Zhao.

Taobao Live, the live-streaming unit of Alibaba launched in 2016, recorded sales close to RMB20 billion (US$2.85 billion) during the 2019 Singles Day shopping event. This accounted for around 7.5% of the group’s overall RMB268.4 billion GMV number. Over 17,000 brands participated in live-streaming this year. One hour into 11.11, GMV generated through live-streaming surpassed last year’s full-day level. As of 10:00 am, over 50% of merchants on Tmall had used live-streaming to sell their products. During peak times, live viewers can amount up to two million people, Alibaba claimed.

The home decoration and consumer electronics categories saw more than 400% year-on-year growth in GMV generated through live-streaming, and the beauty industry more than 200%, according to Alibaba stats. The number of live-streaming sessions during the event also doubled from last year, the company said. More than 10 live-streamers sold RMB1 billion worth of goods on the day. Alibaba is now testing AI-powered instant speech recognition leading to product links displayed on the screen simultaneously, and plans to take video-driven commerce global.

Before today, Alibaba has had three years of time to cultivate consumers to get into a habit of buying from live-streamers and is reaping some results from Taobao Live this year. This year’s Double 11 saw an evolvement from shoppers interacting with products to shoppers interacting with other people (i.e. live-streamers). “If people can directly communicate with each other, many problems like incomplete product information, lack of real human testers and insufficient after-sales service will be solved efficiently,” said Viya (pictured below), Taobao’s top live-streamer who recently collaborated with American reality TV star Kim Kardashian to peddle Kardashian’s lip-shaped KKW perfume. There is evidently a performative element to live-streaming, but these mini-celebrities themselves insist it is impossible to perform all the time, and it is their real selves that are getting favour with online shoppers.

Also, communicating with younger consumers was one driver for Alibaba to invest in the development of its live-streaming capability, reduce signal latency from seven to two seconds, and equip it with more real-time interactive features, said the company’s CMO, Chris Tung. “It’s becoming really different and super engaging and entertaining. It’s a one-of-a-kind experience.”

Shifting from ad-driven traffic to product value and a feedback loop

It’s known that advertising, promotional and operational expenses on leading e-commerce platforms like Alibaba have inflated notably, with CPM (cost per thousand impressions) prices tripling since 2015, according to WPP China’s calculations. As paid ad inventory gets more expensive and margins get lower from extensive discounting, major brands are choosing the annual occasion to launch new products, in order to still capitalise on the soaring traffic from Alibaba’s 700+ million registered members.

Alibaba’s Tung claims there are “more than one million new items that were newly released” this year, but the company defines “new” quite loosely. A new product can be either a global product with its China launch date timed with Double Eleven, a meaningful invention born out of a C2B process through the Tmall Innovation Centre, an imported product sold via a cross-border channel (Tmall Global) or an existing product simply repackaged or rebundled for 11.11. For the latter, for instance, 215 international brands such as Lancome, SK-II, YSL Beaute, Givenchy and Shiseido ‘debuted’ more than 240 11.11-themed special-edition products.

For Samsung, the Korean brand deliberately scheduled its Galaxy Fold smartphone to be launched in China on 6 Nov, two months after its global introduction on 6 Sep. “I think Tmall is not just a platform for sales but also for marketing, because even though not all traffic converts into sales, we gain an opportunity for exposure,” said Steve Feng, CMO for the mobile team under Samsung Electronics China. “Beyond Singles Day, when consumers have nothing to do, they do take the initiative to search for something new on Tmall, so the value our brand gets is more important than the flow of traffic today,” Feng told WARC.

Other aspects of value Samsung gets from Alibaba include expansion of its target audience made possible by Ant Financial’s new instalment schemes for Singles Day. “We used to base our tactics on discounts and coupons, but this put us in an inferior position, so we have offered instalments up to 24 months instead, for some customers who find the Fold too expensive,” added Feng.

In addition, cross-category insights have proved difficult for Samsung in the beginning, but Feng is optimistic of Alibaba’s data bank informing the brand’s upcoming Double Eleven strategies. “Say, if a consumer likes a certain style of clothing that is relatively minimalistic, we can deduce that such a person may like his phone to be relatively simple too. This can be part of our product design in the future.”

.jpg)

.jpg)