'It's Quiet. Too quiet.' Glenmorangie quietly confounds the market

- share

- copy link

Introduction

This paper is an adaptation of our 1998 Scottish IPA Effectiveness Grand Prix winning paper for Glenmorangie TenYearOld Single Malt. In it we shall argue that a change in Glenmorangie's advertising strategy, developed by 1576 Advertising together with a media strategy by MediacomTMB Scotland, is responsible for the significant increases in performance since 1997 when 1576 Advertising took over the account. The change in advertising strategy was, broadly, to target a more mainstream, younger consumer by giving the brand a strong, distinctive personality in order to cut through in the cluttered Christmas environment.

The results achieved are a testament to the bottomline effectiveness of brand advertising. In Year 1 volume sales increases were huge. In Year 2 volume was maintained, indeed slightly enhanced, but importantly the value of the sales was significantly increased. We will argue in this paper that these results are due to the advertising significantly increasing the brand's equity and laying the foundations for a fundamental change in the company's overall business strategy and longterm profitability.

The evidence used comes mostly from sales results from AC Nielsen Scantrack, and our regular tracking study, conducted by The Research Business International. We will demonstrate the increases in Glenmorangie's brand equity by using our own brand equity model, broadly based around David Aaker's Brand Equity Ten.

Definitions

This paper uses a few terms which may need clarification.

The Glenmorangie expressions that this paper is concerned with are the TenYearOld and the Wood Finish Range, and other premium expressions. TenYearOld is the standard Glenmorangie expression.

Wood Finishes are malt whiskies matured in casks which have previously been used to mature another drink, such as Port or Madeira, thus imbuing the whisky with a subtle hint of the original cask contents. These expressions are more expensive than the standard TenYearOld and are therefore 'premium expressions'.

When the term 'Glenmorangie' is used with regard to sales it can be taken to mean all Glenmorangie expressions.

Market background

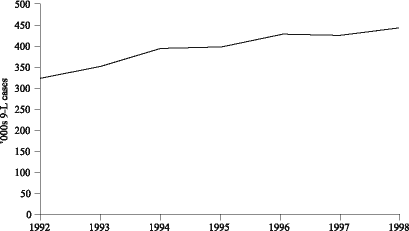

Whisky, comprising blended whiskies and malts, traditionally represents the single largest chunk of the UK spirits market, with roughly 40% of all sales. However, the whisky category has been in slow decline for many years now, with younger drinkers entering the market tending to prefer white spirits, and more recently, premixed drinks. Malts, at the premium end of the market, have held up better than blends, showing slow growth for much of the 1990s (Figure 1 (http://www.warc.com//fulltext/IPAcases/Images/49661f01.htm")).

Traditionally, whisky drinkers would 'graduate' from blends to malts as they became older, more affluent and their tastes more refined. Thus malts would mostly be drunk by the 40plus age group. There was some evidence in 1998 that this pattern of behaviour was changing and that the blends 'stage' was being bypassed by younger drinkers. Hence the following quote from the trade:

'The fast evolving malt category has reversed marketing theory. A few years ago, every distiller held firm to the belief that malt drinkers must first learn to appreciate blends before they could understand the more 'difficult' flavours of malt. This, they alleged, meant that drinkers' palates would mature only when they were in their late 30s. This is palpable nonsense. These days, as many 25 year olds as 50 year olds are drinking malts and are bypassing blends completely. In the UK, Scotch has always run scared of being seen as fashionable: of being too trendy, too accessible to the younger market. Heritage and quality are important but so, surely, is accessibility?' - Caterer and HotelKeeper, September 1998

The leading brand in the UK malt market is Glenfiddich. Glenmorangie is the brand leader in Scotland, a highly significant market for malt whisky, and holds the second largest market share in the UK.

In Year 1 these two brands accounted for about onethird of the UK malt market between them. The next largest brand, Macallan, had a market share of only 5.7%. The 'big two' really make their mark in the massive Christmas gift market which naturally inclines towards wellknown, universally acceptable brands. The 2 months leading into Christmas are particularly important for malt whisky, as it is a popular gift, and 40% of all sales occur in this period.

In order to make the most of the gift market, many brands indulge in discounting to make shortterm share gains, cutting as much as 10 off the price of a bottle in the runup to Christmas. This is also the period when most brands choose to run their advertising, making it a very cluttered and competitive environment.

Advertising Background

Glenmorangie is traditionally a brand which invests in advertising, being the first malt to go back onto television in 1996 when the selfimposed ban on whisky advertising was lifted.

As far as the sector is concerned, many brands have succumbed somewhat to formulaic creative work in recent years. Advertising in this category typically is heavy in technical product information about the traditions and processes involved, complete with stock 'heather and tartan' imagery. This advertising tends to be aimed more at the connoisseur market.

Most malt brands tend to use print media for their campaigns running predominantly in November and December, and no earlier. Glenmorangie, Glenfiddich and Macallan are traditionally the heaviest advertisers. In Year 1, Macallan was the only brand other than Glenmorangie to appear on TV. Consequently, these are the brands we follow on our dedicated tracking survey.

The Task

Glenmorangie's annual report states that its aim is 'to develop and grow the premium malt brands and to improve quality of earnings'. Of primary importance, therefore, is continued growth but with minimal use of discounting. Thus in Year1 the primary objective was to increase volume sales. In Year 2, and the longer term, the aim would be to increase profit margins by maximising the price premium at which Glenmorangie operated in the marketplace, rather than going just for volume gains.

Thus 1576 Advertising was charged with strengthening the Glenmorangie brand in order to achieve these results. Within a relatively static UK malt whisky market and a difficult competitive context many clients would have balked at the idea of running brand advertising. The following quote illustrates Glenmorangie's position on this matter:

'In the face of increased competition and a slowdown in the UK malt market, it would be easy for us to cut back our spending on TV and radio advertising.

However, we strongly believe that current market conditions in the UK make it even more important to invest behind the Glenmorangie brand.'

Source: Glenmorangie Newsletter to all Staff

Our Learning

In the year of our appointment extensive brand and consumer research was conducted in the UK by The Added Value Company on behalf of Glenmorangie. This research concluded that:

'No brand in this market appears yet to have built a truly differentiating product positioning in the eyes of the consumer.'

Source: The Added Value Company

Faced with such a challenging situation, we sought to develop an umbrella positioning for Glenmorangie which was based on an inherent truth about the brand and which tapped into a more emotional reason for drinking a malt beyond heritage. This positioning is:

'Glenmorangie The Taste of Pure Tranquillity'

The name 'Glenmorangie' actually means 'The Glen of Tranquillity' in Gaelic and we believe that this positioning reflects an inherent, emotional benefit of malt whisky drinking relaxation and quiet reflection combined with the functional benefit of purity. However, 'Tranquillity' or relaxation as a benefit is universal to all malts a generic of the market. The challenge for advertising would therefore be

for Glenmorangie to 'own' 'Tranquillity', to take this positioning and to mould it into a distinctive, more contemporary brand persona which would appeal to a wider audience.

The research conducted with The Added Value Company told us that the consumer psychology of the malt whisky market is highly complex. There is a significant proportion of the market who are connoisseurs, highly knowledgeable about the manufacture and characteristics of malts who will tend to drink from a repertoire of brands, many of which are only available in limited quantities from specialist retailers. At the other end of the scale are occasional drinkers who may only acquire malts as gifts. These people tend to be unaware of the distinction between malts and blends, other than by price.

Research indicated that the segment with the greatest possibility for growth lay somewhere in the middle ground between these two extremes with mainstream consumers. These people have little knowledge of the market, but importantly have the potential to become highly involved malt consumers. Furthermore, this group is growing due to the trend towards bypassing the blends stage of whisky drinking. Not only are there a lot of these people, but they are largely neglected by malt advertising activity and thus presented us with a considerable opportunity.

These mainstream malt whisky drinkers can be broadly categorised as ABC1 males, 3045 years old, but we were aiming for the younger end of this group to encourage new drinkers to enter the market. This type of malt drinker has a huge respect for malts but doesn't really understand them, nor does he want to know too much technical detail. He's looking for what a malt can give him on an emotional level. He wants to sit down quietly at the end of a hard day with a drink that helps him to relax and reflect. In short, he is ideally suited to our positioning for the Glenmorangie brand and it was created with him in mind.

The creative idea

We knew who we wanted to drink Glenmorangie, we knew what we needed to tell them in order to convince them to try it; now what was required was a compelling creative idea.

We wanted to build on our 'truth' about the product and wrap it in a contemporary, clever and wryly humorous tone of voice to appeal to a younger, less stuffy audience. We decided to use the fact that the name Glenmorangie actually means 'Glen of Tranquillity' as the basis of the idea and created an actual place somewhere beautiful, peaceful, reflective and intrinsically Scottish.

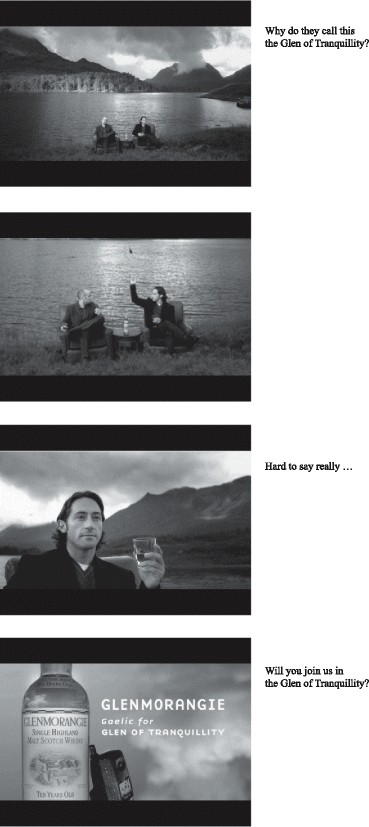

The campaign uses two central male characters, both in their early 30s. They sit in glorious Scottish highland landscape, endeavouring to maintain the tranquillity whilst sipping their Glenmorangie.

The lead script shows our two friends sitting quietly by a loch as we hear one of the men's mobile phone disturb the silence, ringing insistently. Without hesitation the second man grabs the phone and throws it in the loch. Peace returns and the viewer is asked 'Will you join us in the Glen of Tranquillity?' (Figure 2 (http://www.warc.com//fulltext/IPAcases/Images/49661f02.htm")).

The initial campaign consisted of two 20" commercials, one 10" commercial and two radio commercials.

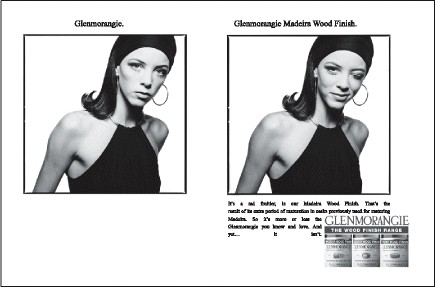

In Year 2 we wanted to additionally highlight the Wood Finish expressions to get people who had only ever tried TenYearOld to trade up to Wood Finish instead a bottle of this costs about 5 more than the TenYearOld. Our own research warned us not to suggest that the differences between the TenYearOld and the Wood Finishes were too pronounced as consumers might think that the drink had been 'tampered with' in an unappealing way. To that end we produced a series of press executions which used a set of two subtly different images to highlight the small, yet distinctive differences between the TenYearOld and Wood Finish expressions (Figure 3 (http://www.warc.com//fulltext/IPAcases/Images/49661f03.htm")).

Media Strategy The Thinking

In conjunction with 1576 Advertising, Mediacom TMB Scotland reviewed when and how we spent Glenmorangie's media budget to compete effectively in such a hugely competitive marketplace. We decided to launch the Christmas campaign for Year 1 in October for the first time, prior to the really busy Christmas onslaught, in order to 'prime the pump' and build awareness. No other malt brand had begun its campaign this early before.

From a targeting point of view, cluster analysis told us that malt whisky drinkers were going to be hard to reach as they tended to be light and fragmented media consumers, particularly of TV. However, we identified a state of mind common to all malt drinkers a desire for moments of relaxation and contemplation in many areas of their lives, but also in the programmes they choose to watch. These moments reflected, for them, the personal nature of sitting down privately and savouring a glass of malt. These 'Personal Appreciation Moments' (PAMs) not only allowed us to isolate our desired audience, but also placed them in the most receptive state of mind for the advertising we had devised.

We then 'cherry picked' TV programmes and specific times on radio stations where malt drinkers were most likely to be enjoying a PAM.

Similarly, in Year 2, the press executions were placed in the magazine sections of the weekend press, often in the food and drink sections, which would be read whilst relaxing on a Saturday or Sunday afternoon over a cup of tea, or possibly even a glass of malt.

Media Strategy The plan

Tenyearold

A threestage plan was developed for TenYearOld, and broadly followed the same pattern in both years. An important factor was starting the advertising earlier than in previous years to steal a march on the competition.

- Phase I Awareness building

20" TV drip activity throughout October.

- Phase II Consolidation

Main burst: 20" and 10" TV and radio in November.

- Phase III Maintenance

10" drip TV and radio through to the end of the Christmas period.

The TV activity appeared on STV, Grampian, North (Tyne Tees, Border, Yorkshire, Granada), HTV, C4 and C5 Scotland, C4 and C5 North. Radio placements were on Virgin AM and Classic FM.

Wood finish

In Year 2, broadsheet press advertising for Wood Finish was added to the mix. Beginning in October, this campaign ran through to Christmas in specific spaces in selected titles, e.g. the food and drink section in the Sunday Telegraph.

Hitting the objectives

In Year 1 our objective was to increase sales of TenYearOld. Our strategy allowed us to reach this target because the campaign would appeal to a wider target market, and give them a compelling emotional reason to prefer Glenmorangie to its competitors.

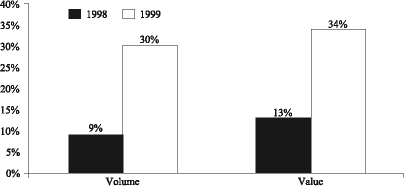

Year 2 coincided with the Millennium, and was therefore forecast to be a bumper year for malt sales. Evidently this represented an enormous opportunity for volume gains within the malt category, as whichever brand could secure the best distribution and indulge in the deepest price cuts would be very likely to capitalise on the new oneoff customers brought in by the Millennium.

To their credit, Glenmorangie saw through this shortterm opportunity and instead realised that, owing to the strong advertising it was running, the brand could in fact support a price premium. To quote Jim Cook, Glenmorangie's UK Sales Director:

'We decided to take the responsible option in this situation, rather than going for shortterm volume through discounting, and as a result are the only brand to have added significant value to the category this year.'

Therefore in Year 2 the objective shifted to maintaining a price premium over the competition, whilst maintaining sales in the face of heavy discounting by other brands.

To achieve this we ran our advertising in much the same manner as in Year 1, but without so much support from price reductions. This would continue to build the brand. Secondly, the press work for Wood Finish would persuade existing TenYearOld drinkers to trade up to the higher priced expressions, driving up the average value of all Glenmorangie sold.

RESULTS

In this section we will demonstrate that we actually bettered our objectives by increasing volume sales in both years while also growing the price premium in Year2 by driving sales of the premium expressions.

YEAR 1

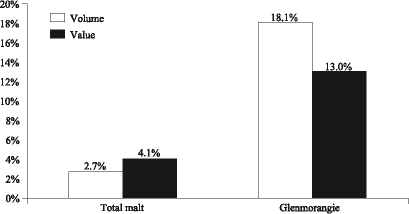

Our objective for Year 1 was to increase sales. There can be no question that this objective was achieved successfully Glenmorangie significantly outperformed the category in both volume and value sales.

Scantrack results

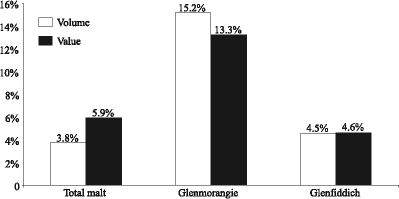

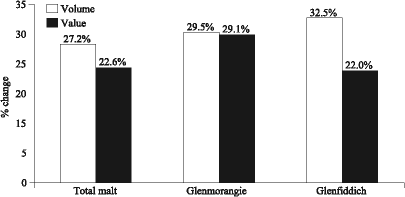

Scantrack gives us actual sales data for all whisky brands over the advertised period. Glenmorangie's volume sales rose by 18.1% for the preChristmas bimonth year on year, while value sales rose by 13%. As can be seen from Figure 4, (http://www.warc.com//fulltext/IPAcases/Images/49661f04.htm") this outperformed the category.

Glenmorangie's performance in the multiple grocers, where our mainstream target market was most likely to shop for their whisky, was even more impressive, showing volume gains of 27.2% year on year.

Overall, these gains led to a 15.2% increase in Glenmorangie's MAT sales, again outperforming both Glenfiddich and the category, and demonstrating just how crucial this period is (Figure 5 (http://www.warc.com//fulltext/IPAcases/Images/49661f05.htm")).

The sales gains translate into an increase in volume sales of 76,000 litres of whisky at a value of 2,674,321, evidence of just how significant these increases were, coming from an already large base. Glenmorangie gained market share in the UK as a result, particularly in the psychologically important Scottish market, where brand leadership was deemed to be essential (Figure 6 (http://www.warc.com//fulltext/IPAcases/Images/49661f06.htm") and 7

(http://www.warc.com//fulltext/IPAcases/Images/49661f07.htm")).

Explaining year 1 results

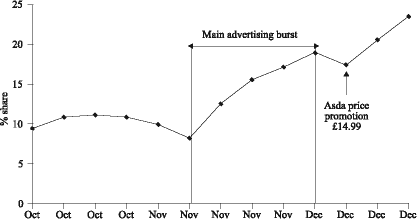

The Scantrack data show that Glenmorangie's share in the multiple grocers immediately started to rise in an impressive upward curve as soon as the main TV burst kick in, in November (see Figure 8 (http://www.warc.com//fulltext/IPAcases/Images/49661f08.htm")). This is maintained all the way through to Christmas. The advertising really had a 'double whammy' effect. The drip campaign primed the main burst so that it immediately uplifted sales when it cut in; and the main burst primed the key December promotional period.

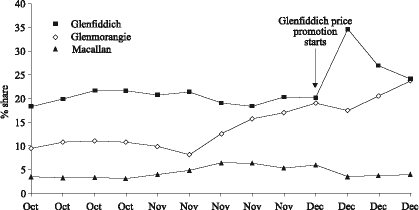

Considering that Macallan was also on TV, although at a slightly later date than Glenmorangie, it experienced nothing like the same results. Neither did the brand leader, Glenfiddich, who left its main advertising spend until the more traditional December sales period and chose posters as its medium. The result being that Glenmorangie closed the gap from around 7% behind Glenfiddich in multiple grocers, nationally, at the start of the campaign to virtually equal share by the end, and indeed in UK multiple specialists, achieved brand leadership for the first time in the brand's history. The Macallan saw absolutely no effect (Figure 9 (http://www.warc.com//fulltext/IPAcases/Images/49661f09.htm")).

As can be seen from Figure 8 http://www.warc.com//fulltext/IPAcases/Images/49661f08.htm"), an Asda price promotion on Glenmorangie in the second week of December also caused a major uplift. However, examining the brands in Figure 9 we can see that Glenfiddich's only real uplift in sales coincided exactly with its own price promotion. We cannot deny the effects of price promotions on Glenmorangie sales, but later in this section we will show that these effects can be isolated from those due to advertising.

We can also see from Figure 9 that no other advertised brand was achieving similar results, so there must be some factor separating Glenmorangie from the competition. The fact that Glenmorangie sales rose in line with the timing of the advertising whereas Glenfiddich's rose in line with the timing of a price promotion is another clue.

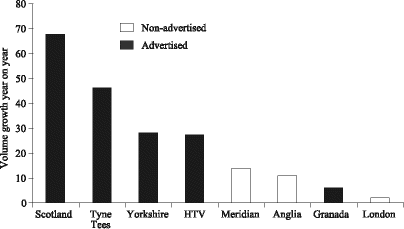

But, could Glenmorangie have simply been experiencing a more subtle promotional boost? We examined our sales by TV region to see if there was any difference between advertised and nonadvertised regions. Sure enough, as is shown in Figure 10 (http://www.warc.com//fulltext/IPAcases/Images/49661f10.htm"), the nonadvertised regions showed small increases compared with the advertised, despite the fact that price promotions were running nationally.

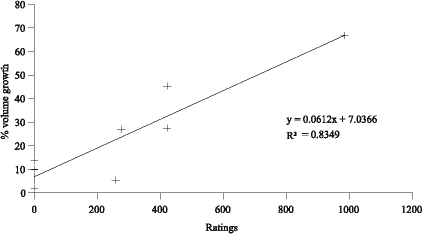

Fundamental proof that the advertising was responsible for these changes came when we plotted the TV ratings for each region against the sales increases in that region (Figure 11 (http://www.warc.com//fulltext/IPAcases/Images/49661f11.htm")). We performed a linear regression analysis which showed with 95% certainty that the sales in each region depended on the TV ratings. The equation derived shows that without advertising, an increase of 7.04% is predicted, which we attribute to price promotions. Any growth over this figure is due to an advertising effect.

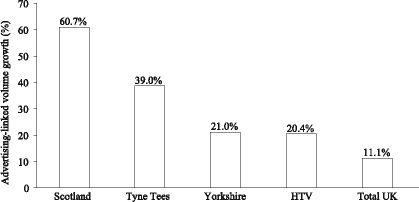

Having isolated the advertising effect in this way, showing that all growth beyond 7.04% is solely attributable to the advertising, we can really see the dramatic effect that the advertising had across all the regions (Figure 12 (http://www.warc.com//fulltext/IPAcases/Images/49661f12.htm")). From these results we can also calculate an approximate return on investment for Year 1 of 209% on the original 662,000 spent on media.

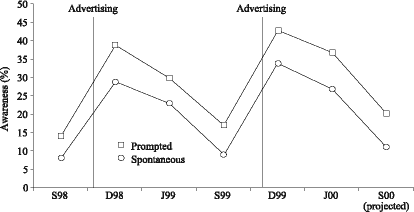

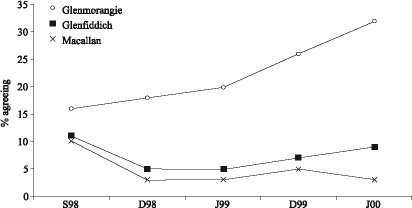

Further evidence came from the results of our tracking study. Advertising awareness rose steeply during the campaign, so we know that the advertising registered with the target market (Figure 13 (http://www.warc.com//fulltext/IPAcases/Images/49661f13.htm")). Glenfiddich and Macallan saw no comparable effect.

Furthermore, the number of respondents who associated Glenmorangie directly with 'tranquillity' also rose, so we know the advertising was having the desired effect.

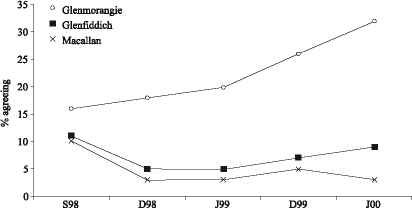

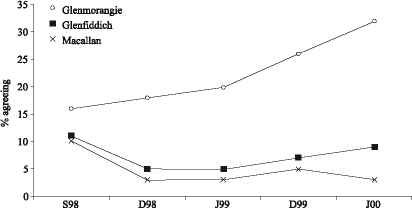

Figure 14 (http://www.warc.com//fulltext/IPAcases/Images/49661f14.htm") also shows us that increases in Glenmorangie's association with tranquillity were mirrored by a falling off of other brands' associations with that property. This shows very neatly that we are on the way to owning this generic for the Glenmorangie brand.

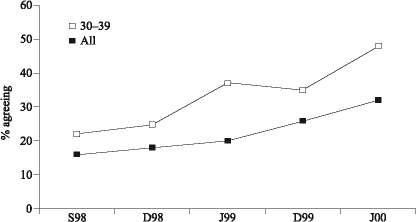

The 3039 age group, our main target market, were significantly (at the 0.05 level) more likely to associate Glenmorangie with tranquillity, as Figure 15 (http://www.warc.com//fulltext/IPAcases/Images/49661f15.htm") shows.

YEAR 2

Our objectives for Year 2 were to increase our price premium over the competition whilst maintaining volume. In other words, to build brand value.

Scantrack results

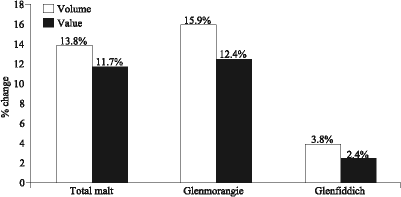

As in Year 1, Glenmorangie outperformed the category in both volume and value growth during the bimonth, thus exceeding our objective of maintaining share. Figure 16 (http://www.warc.com//fulltext/IPAcases/Images/49661f16.htm") also shows that although Glenfiddich showed greater year on year volume growth than Glenmorangie, the former's value growth was very low in comparison. This indicates that Glenfiddich had effectively bought extra share by discounting, something we will examine more systematically later.

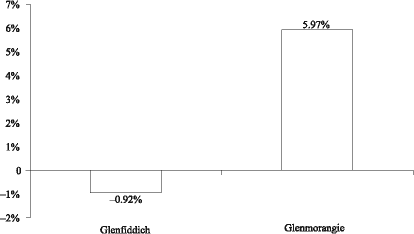

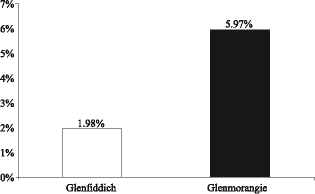

Glenmorangie also showed a strong performance over the entire year. For the second year running it convincingly outperformed the category on volume and value growth (Figure 17 (http://www.warc.com//fulltext/IPAcases/Images/49661f17.htm")). This was helped, in part, by an extremely successful Father's Day. For the first time, brand equity was successfully leveraged during this important giftbuying period, leading to volume growth of 74.6%. Glenfiddich, by contrast, had an extremely poor year.

The sales gains translate into an increase in volume sales of 89,100 litres of whisky at a value of 2,641,000. Again, Glenmorangie increased its market share as a result (Figure 18 (http://www.warc.com//fulltext/IPAcases/Images/49661f18.htm")).

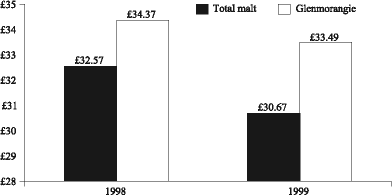

The objective for Year 2 was to maintain a price premium over the competition, without losing market share. From total volume and value sales we can calculate the average price per litre of actual whisky sold (as opposed to claimed retail price). These results are summarised in Figure 19 (http://www.warc.com//fulltext/IPAcases/Images/49661f19.htm").

As can be seen, Glenmorangie commanded a higher price premium over the sector in Year 2 than in Year 1, equivalent to a 56% increase year on year. This is because of large increases in the sales of Glenmorangie's premium expressions (Figure 20 (http://www.warc.com//fulltext/IPAcases/Images/49661f20.htm")).

EXPLAINING YEAR 2 RESULTS

Evidently we need to show that advertising and not some other factor is responsible for the Year 2 results. Unfortunately we could not perform the same analysis that we used for Year 1 owing to some regional discounting.

Instead we examined the relative price changes, year on year, for all the major malt brands and plotted them against the volume increases they recorded over the bimonth. The points lay on a curve, so we used simple polynomial regression to create a model. This model allowed us to predict with 95% certainty (from a 2tailed, paired ttest) what volume changes would be expected from any given pricing strategy. The results of this are summarised in Table 1.

TABLE 1: PREDICTED VOLUME CHANGES FROM MODEL

|

Brand |

Price ratio1999/1998 |

Predicted volume change (%) |

Volume change (%) |

Difference (%) |

|

Glenmorangie |

0.996911 |

13.8 |

29.5 |

15.7 |

|

Glenfiddich |

0.92075472 |

57.9 |

32.5 |

25.4 |

|

Macallan |

1.02881356 |

7.5 |

18.0 |

10.5 |

|

Glenlivet |

0.84232804 |

181.8 |

183.5 |

1.7 |

|

Laphroaig |

0.91272929 |

66.2 |

79.9 |

13.7 |

|

Classic 6 |

1.04750594 |

5.3 |

15.8 |

21.1 |

|

Bowmore |

1.14723204 |

16.4 |

15.1 |

1.3 |

|

Source: 1576 Advertising |

||||

As can be seen, brands such as Glenlivet, which discounted heavily, selling at

12.99 in the CoOp, recorded large volume increases in line with the model's predictions. Glenmorangie, however, recorded a considerably larger volume increase, some 15.7% higher than predicted, indicating that some factor other than price made consumers more likely to buy Glenmorangie. By contrast, Glenfiddich sold 25.4% less than they ought to, given their pricing strategy.

Goingnback to the tracking study

(Figures 13 (http://www.warc.com//fulltext/IPAcases/Images/49661f13.htm"),14 (http://www.warc.com//fulltext/IPAcases/Images/49661f14.htm") and 15 (http://www.warc.com//fulltext/IPAcases/Images/49661f15.htm")) we can see that awareness and association with tranquillity also rose during Year 2. Furthermore, our simple model predicts that the baseline level to which the advertising awareness decays will also rise, indicating a longterm effect. It is important that this result was recorded, as it indicates that the changes in brand equity are due to advertising and not some other factor.

The combination of rising awareness of the advertising, strong associations with tranquillity and increased price premium and sales lead us to the inescapable conclusion that these results are best explained by an increase in the strength of the Glenmorangie brand. Our strategy to appropriate tranquillity has worked and been translated into increased sales, and has added sufficient value to the brand for it to operate at a 56% higher price premium than before. As Jim Cook put it:

'Consumer equity in the brand is now stronger than it's ever been. We feel like a brand leader and think that its time we started acting as the brand leader should.'

1576's SEVEN STEPS TO BRAND HEAVEN

To further examine a brand strength explanation, we have developed a brand equity model, loosely based on American academic David Aaker's brand equity ten. In an ideal world we would have been able to compare brand valuation data for before and after the campaign. As this is not the case, we have created what we feel is a robust model, which, combined with the volume and value increases detailed above, should confirm that we have added value to the Glenmorangie brand.

Our model uses seven indices of consumer brand equity to allow us to measure how it changed over the course of the campaign. As we shall show in the next few pages every index of brand equity, bar one, increased or was static over the course of the campaign.

Indices of brand equity are as follows: Brand awareness

Emotional proximity to the brand Perceived quality

Loyalty Market share

Distribution, i.e. weighted percentage of outlets carrying the brand Price premium

- Brand awareness

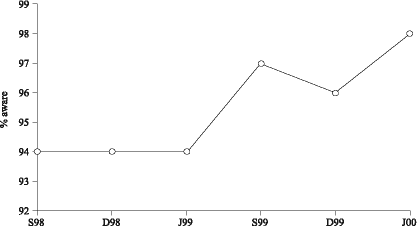

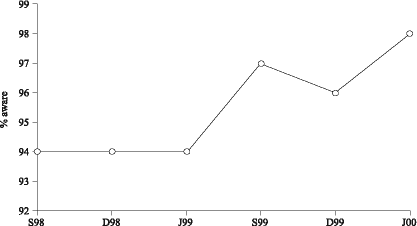

From the tracking study we measured total numbers of whisky drinkers who were aware of the Glenmorangie brand. As it is a leading brand, these figures are, of course, close to the ceiling to begin with, but we still recorded an increase (Figure21 (http://www.warc.com//fulltext/IPAcases/Images/49661f21.htm")).

- Emotional proximity

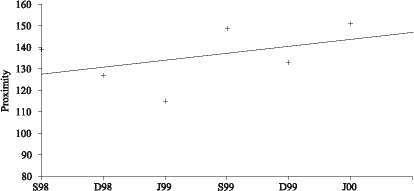

Our tracking study asked respondents who were aware of the Glenmorangie brand how close they felt to it, and graphed the results as an emotional proximity score, which consistently rose throughout the campaign (Figure 22 (http://www.warc.com//fulltext/IPAcases/Images/49661f22.htm").

- Perceived quality

This was the one index along which Glenmorangie may have lost ground. We measured this as a percentage of respondents agreeing that Glenmorangie was 'an expensive malt', this figure dropped across Years 1 and 2 (Figure 23 (http://www.warc.com//fulltext/IPAcases/Images/49661f23.htm")).

It could, of course, be argued that a fall in this index, in the context of our advertising strategy, is a major positive. Being seen as an expensive malt is certainly indicative of perceived quality, but it also distances the mainstream consumer from the brand. For these reasons, we feel safe in claiming that brand equity has risen despite the slight fall in this single measure.

In fact, this is a major clue as to what is really going on with this brand. In a nutshell, we have taken an exclusive, highstature product with relatively limited appeal and transformed it into a salient, modern brand with broad appeal. Of necessity, this requires sacrificing some of the brand's stature for added saliency, a classic marketing tradeoff.

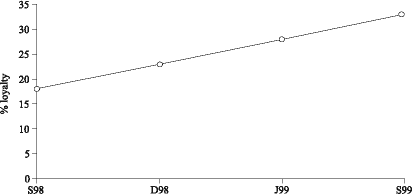

- Loyalty

We asked Glenmorangie drinkers what its position was in their portfolio, i.e. 'the only brand I ever drink' or 'one of a number I drink'. We then converted this to a loyalty score, which has consistently risen over the course of the campaign (Figure24 (http://www.warc.com//fulltext/IPAcases/Images/49661f24.htm")).

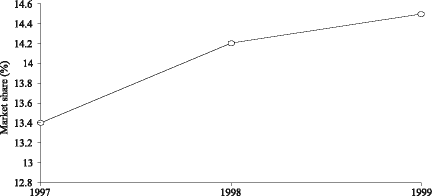

- Market share

As we have already shown, Glenmorangie has consistently gained market share. This is reiterated in Figure 25 (http://www.warc.com//fulltext/IPAcases/Images/49661f25.htm").

- Distribution

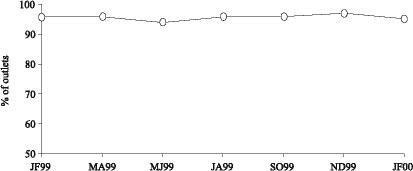

Weighted distribution percentages have remained static and close to ceiling for the duration of the campaign (Figure 26 (http://www.warc.com//fulltext/IPAcases/Images/49661f26.htm")).

- Price premium

As discussed in the section on Year 2 results, we can demonstrate that this rose by 56% between Years 1 and 2 (see Figure 19 (http://www.warc.com//fulltext/IPAcases/Images/49661f19.htm") for details). To summarise:

Brand awareness Risen Emotional proximity Risen Perceived quality Fallen Market share Risen Distribution Static

- Loyalty Risen

- Price premium Risen

- So we can confidently say that Glenmorangie's brand equity has risen.

CONCLUSION

To recap: our objectives were to increase sales in Year 1 and then to maintain this increased market share in Year 2 whilst increasing our price premium over the rest of the category. We proposed to do this using a branding campaign designed to appeal to a younger malt whisky drinker and which would appropriate the generic benefit of tranquillity for the Glenmorangie brand.

Our results show that we have, without question, increased volume sales in Year 1 and increased the price premium in Year 2. The simple mathematical models used have demonstrated robustly that these effects are due to the advertising. Other measures show that our advertising did register with our target market and that we did indeed appropriate tranquillity.

The 'Seven Steps' brand equity model shows that brand equity has risen over the advertised period, so we would postulate the following as the most likely explanation for our results:

CAMPAIGN BREAKS

- 'Glen of Tranquillity' cuts through to new malt drinkers

- Target market convinced of emotional benefit of Tranquillity

- Brand equity increases

- Volume increases (in combination Higher price premium supported with promotions)

- Our client is happy!

In short, we have hit every objective we have been set, and more, and there is every reason to believe that this advertising campaign has succeeded in exactly the way it was planned. And now that this is done, I think I'll go get me some of that tranquillity I've been on aboutand you probably need some too.

NOTES & EXHIBITS

FIGURE 1: TOTAL MALT MARKET VOLUME 1992�1998

FIGURE 2: STORYBOARD FOR 20" 'MOBILE PHONE' AD

FIGURE 3: PORT WOOD FINISH PRESS AD

FIGURE 4: BIMONTHLY VOLUME AND VALUE CHANGES, YEAR 1 (TOTAL TRADE)

Source: Scantrack

FIGURE 5: MAT VOLUME AND VALUE CHANGES, YEAR 1 (TOTAL TRADE)

Source: Scantrack

FIGURE 6: BRAND VOLUME SHARE CHANGES, YEAR 1 (UK OFF�TRADE MAT)

Source: Scantrack

FIGURE 7: BRAND VOLUME SHARE CHANGES, YEAR 1 (SCOTLAND OFF�TRADE MAT)

Source: Scantrack

FIGURE 8: GLENMORANGIE BRAND SHARE BY VOLUME, UK MULTIPLE GROCERS, OCTOBER�DECEMBER 1998

Source:  Scantrack

Scantrack

FIGURE 9: PERCENT VOLUME SHARE BY BRAND, UK MULTIPLE GROCERS OCTOBER�DECEMBER 1998

Source: Scantrack

FIGURE 10: VOLUME CHANGE BY TV REGION, YEAR 1 (UK TOTAL TRADE MAT)

Source: Scantrack

FIGURE 11: PLOT OF TV RATINGS AGAINST VOLUME INCREASES BY REGION, SHOWING REGRESSION LINE AND EQUATION

Source: 1576 Advertising

FIGURE 12: ADVERTISING�LINKED VOLUME GROWTH (UK OFF- TRADE) BY TV REGION

Source: 1576 Advertising

FIGURE 13: GLENMORANGIE ADVERTISING AWARENESS (UK WHISKY DRINKERS)

Source: TRBI

FIGURE 14: BRAND ASSOCIATIONS WITH 'TRANQUILITY' (UK WHISKY DRINKERS)

Source: TRBI

FIGURE 15: ASSOCIATION WITH 'TRANQUILITY': 30�39 YEAR�OLDS COMPARED WITH ALL RESPONDENTS

Source: TRBI

FIGURE 16: BIMONTHLY VOLUME AND VALUE CHANGES, YEAR 2

Source: Scantrack

FIGURE 17: MAT VOLUME AND VALUE CHANGES, YEAR 2 (TOTAL TRADE)

Source: Scantrack

FIGURE 18: BRAND VOLUME SHARE CHANGES, YEAR 2 (UK TOTAL TRADE)

Source: Scantrack

FIGURE 20: PREMIUM EXPRESSIONS AS A PROPORTION OF TOTAL

Source: Glenmorangie

FIGURE 14: BRAND ASSOCIATIONS WITH 'TRANQUILITY' (UK WHISKY DRINKERS)

Source: TRBI

FIGURE 21: TOTAL BRAND AWARENESS

Source: TRBI

FIGURE 22: EMOTIONAL PROXIMITY TO GLENMORANGIE

Source: TRBI

FIGURE 23: BRAND IMAGE: EXPENSIVE MALT (% AGREEING)

Source: TRBI

FIGURE 24: LOYALTY OF GLENMORANGIE DRINKERS

Source: TRBI

FIGURE 25: GLENMORANGIE MARKET SHARE (% VOLUME)

Source: Scantrack

FIGURE 26: WEIGHTED PERCENT OF OUTLETS CARRYING GLENMORANGIE

Source: Glenmorangie

FIGURE 19: PRICE PER LITRE DURING PRE�CHRISTMAS BIMONTH (OFF�TRADE)

Source: Scantrack

.jpg)

.png)